MyMoney Newsletter

This is our personal finance newsletter that contains a variety of articles and tips to help you with your finances.

Current issue:

Here are some of our past issues:

- August 2025 MyMoney Newsletter

- January 2025 MyMoney Newsletter

- August 2024 MyMoney Newsletter

- March 2024 MyMoney Newsletter

- October 2023 MyMoney Newsletter

- January 2023 MyMoney Newsletter

- March 2022 MyMoney Newsletter

- June 2021 MyMoney Newsletter

- February 2021 MyMoney Newsletter

- November 2020 MyMoney Newsletter

Children's "FUN"ancial Education Workbook

All children become interested in money and the idea of what it does at different times during their development. If your child has displayed this interest, it may be time to start introducing them to the different aspects of personal finance. We hope this guide will assist you in teaching them the very basics while having fun!

Learn Now or Pay Later Financial Literacy Guide

Our Learn Now or Pay Later Financial Literacy Guide provides readers with a detailed, yet easy-to-understand reference about many personal finance-related topics. This guide identifies the building blocks of a sound financial plan, and includes information about building a spending plan, establishing short- and long-term goals, understanding your credit report and score, and how to use credit wisely.

Learn Now or Pay Later Young Adult Financial Literacy Guide

Our Learn Now or Pay Later Young Adult Guide provides the same level of education as our adult guide, but delivered in a way that's more relevent to our younger adult audience. We still cover the basics: credit reports, credit scores, debt-to-income ratios, budgeting, checking and savings, and a lot more information to help our young adults be financially-responsible older adults!

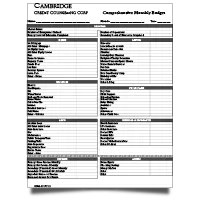

Monthly Budgeting Worksheet

Many of us are reluctant to establish a household budget because we fear that we simply won't be able to do the things we are accustomed to doing. Of course, this is not true. Creating a household budget helps us to identify the most important expenses and helps us to ensure that they are covered every month. It also makes us stop and think before we make certain purchases and helps us to trim expenses that are just not necessary.

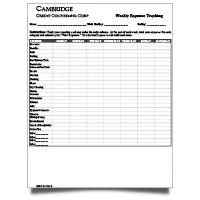

Weekly Journalizing Worksheet

The only real way to know exactly where your money is going is to write down every expense you make...and we mean everything! Once people start journalizing their expenses, even if just for a week or two, they are amazed to see where their money is actually being spent! We've made it easy for you to journalize your weekly expenses with this worksheet. Simply write down everything you spend money on throughout the week!

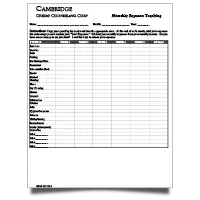

Monthly Journalizing Worksheet

Once you've completed your weekly journalizing exercises, it's time total everything up and find out where your money is going every month. This can be a truly eye-opening experience for some people when they realize that, at the end of the month, that daily cup of coffee cost them $100 and that bagel they get along with it cost them another $50! Cutting out, or cutting down on simple expenses like these can really add up and free up money that you didn't even know you had, and you never would have realized it without journalizing.

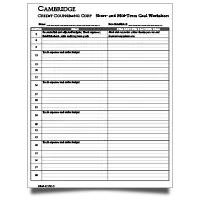

Short-Term Goals Worksheet

Another important step to getting your financial life back on-track is to set reasonable goals for yourself. You can't expect to be debt-free overnight. You have to first understand the goals you want to achieve in the short-term, which will help you reach your ultimate long-term goals. This simple worksheet will help you establish these short-term goals.

Long-Term Goals Worksheet

Your short-term goals are established as stepping stones to helping you reach your ultimate, long-term goals. While short-term goals are tracked in terms of weeks or months, your long-term goals will usually be measured in years. Download this simple tracking sheet to help you manage your long-term goals.

Cambridge Corporate Brochure

Our latest Corporate Brochure will provide you with an overview of all Cambrirgde's debt relief services. Our services include Credit Counseling, Housing Counseling, Reverse Mortgage Counseling, Bankruptcy Counseling, 1st-Time Homebuyer Education Courses, and Student Loan Debt Counseling.